Early in the pandemic, the Bank of Canada made a deliberate decision to keep interest rates low to offset the impact of the pandemic on Canadian households and businesses. Specifically, their intent was to “help Canadians bridge this difficult period by making credit affordable and available.” (BoC)

Low borrowing rates and the new realities of remote work led many to reconsider where they live and the size and type of property they owned. Home offices duelling for space with at-home school activities made many consider relocation to Census Metropolitan Areas where existing budgets meant more space. As well, first-time homebuyers were eager to buy and capitalize on low interest rates. And that’s where Canada runs into a supply problem.

Canada does not have enough housing with the lowest average housing supply per capita among G7 countries, with 424 units per 1,000 people. Ontario, in particular, needs over 650,000 additional housing units to meet the average number of units per capita available in other provinces. When you combine the increase in demand created by low interest rates and families looking for more space with a supply problem, the result can be the housing frenzy we’ve seen since 2019.

That’s the “why” driving growth in Canadian real estate, but let’s take a closer look at 2021.

2021 Market insights

The Teranet-National Bank House Price Index provides a representation of the rate of change in Canadian single-family home prices. The measurements are based on the property records of public land registries—a source that guarantees all transactions are captured including builder-to-buyer, private or exclusive sales.

Analysis of 2021 data indicates that Canadian house prices rose 15.5% in 2021 year over year, breaking a five-year record in the process. A deeper dive into sales in Ontario in 2021† tells an interesting story.

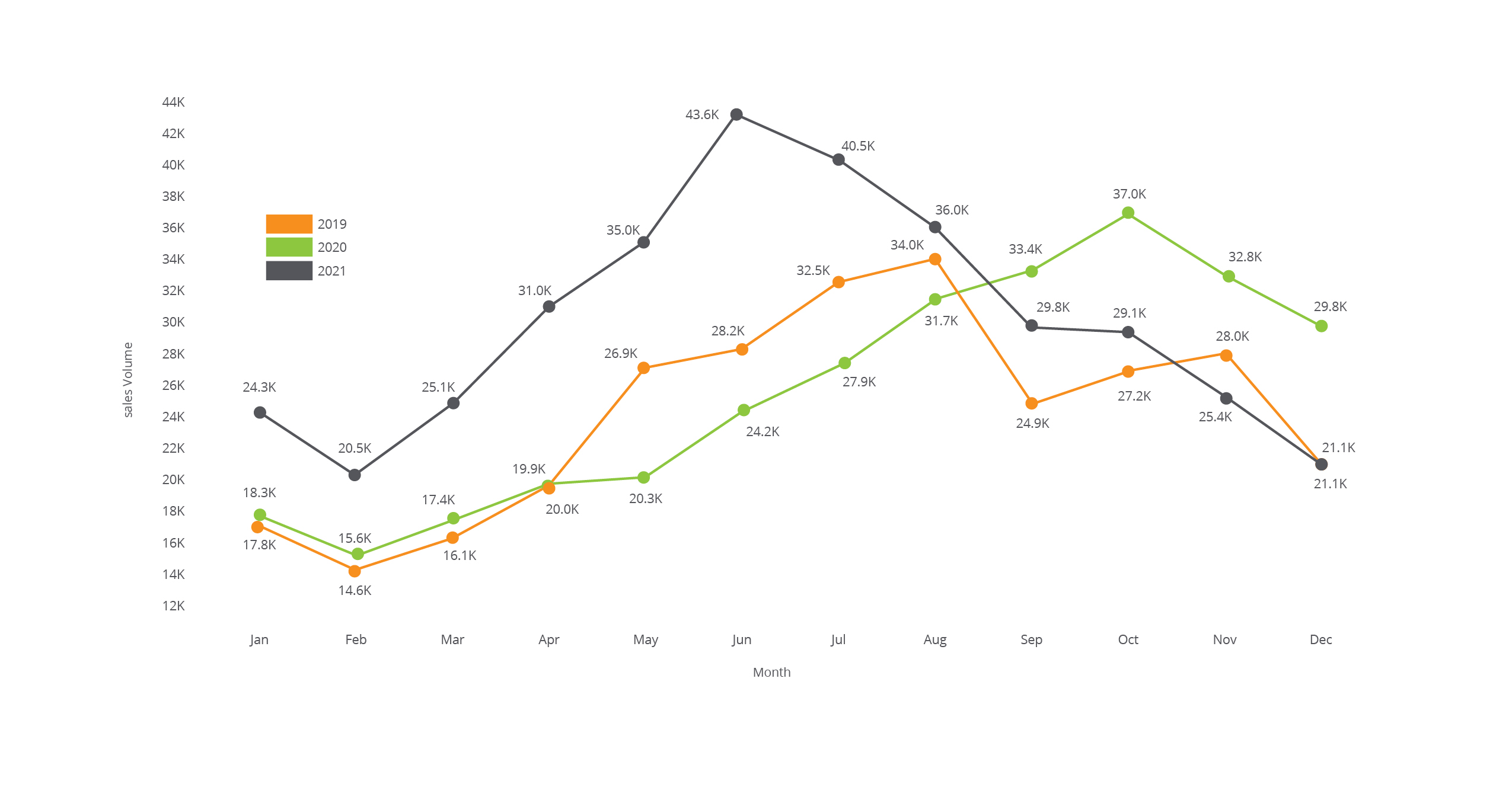

Sales

First, let’s talk about sales. The average sale price of a single-family home in Ontario in 2021 was $695.07K, up 23.7% from 2020. There were 361,500 sales—an increase of 17.2% from 2020. The rate of sales peaked in June 2021 with over 43,600 transactions that month. The last quarter of 2021 saw a sharp drop back to pre-pandemic sales volume experienced in December 2019.

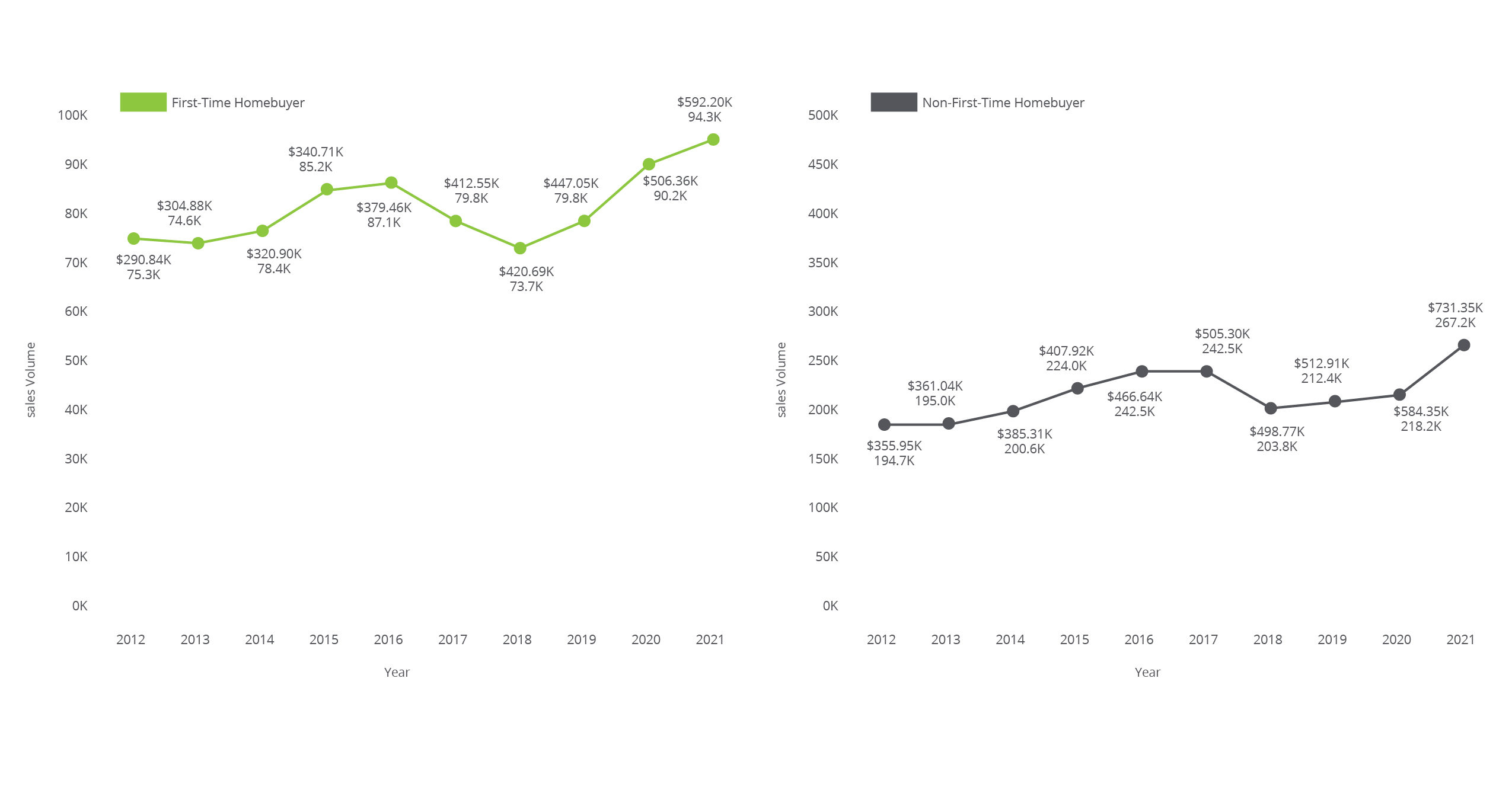

First-time homebuyers

Low interest rates and government incentives brought out eager first-time homebuyers (FTHB), but it was repeat buyers who drove the increase in sales volume in 2021. First-timers represented just 27.7% of total sales volume on housing priced below the average provincial sale price.

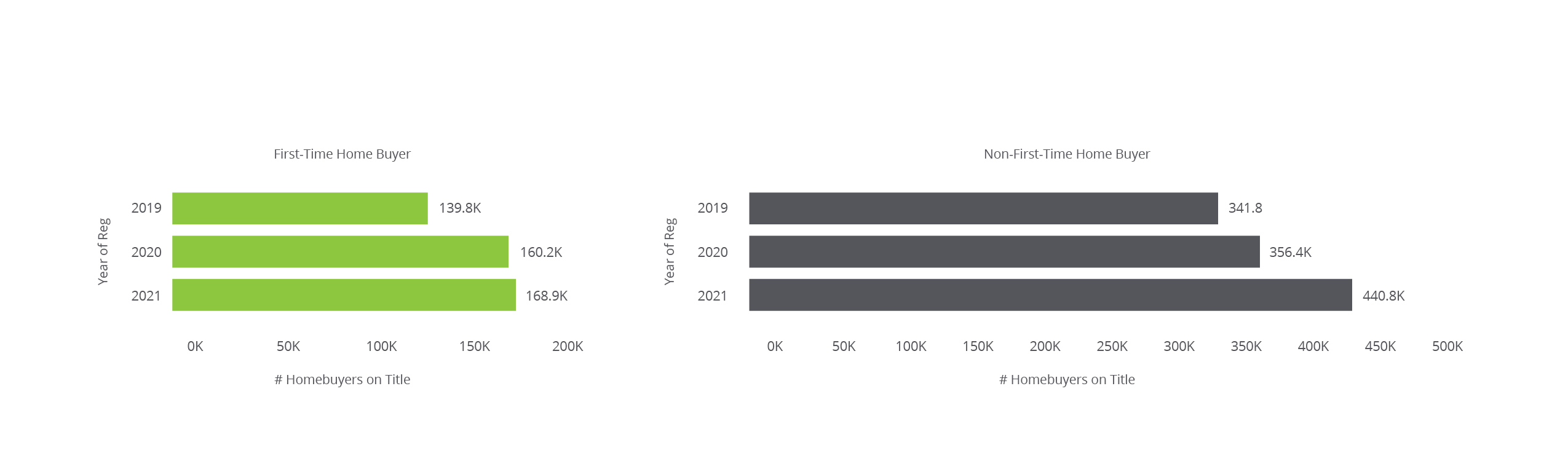

Number of buyers on title

The average price of a home has increased over $200,000 since 2018. This increase has priced many properties out of range for solo buyers (or couples). In response, buyers became more creative, purchasing property with other people on title. The volume of multi-buyer sales (three or more people on title) increased to 440, 800 in 2021 from 341,800 in 2019.

What’s ahead in 2022

Inflation reached a 30-year high of 4.8% in December 2021. Supply-chain and transportation disruptions due to COVID have made significant contributions to the rise in inflation. Normally, interest rates would rise to encourage saving and result in decreased borrowing and spending.

On January 26, 2022 the Bank of Canada announced that it would – for now – keep interest rates steady. This is good news for homebuyers hoping to get into the market in the first quarter of the year. But this won’t hold. Interest rate hikes are expected beginning March 2 and are expected to be adjusted upward as many as five times in 2022. This may create a more balanced Canadian housing market.

The federal government has made housing supply a priority. In 2021, housing starts were up 20.8% while completions increased by 8.3% from 2020 (CMHC). That may still mean stiff competition for what housing is available – no matter where the interest rate settles.

Teranet releases Market Insight Reports and hosts Market Insight Forums that provide timely insights into current housing marketing conditions. Subscribe to receive these reports as soon as they are released.

† Data from the last quarter of 2021 may be incomplete due to a lag in data submission. When a mortgage registration (charge or discharge) is submitted to the land registry, Teranet’s system will receive the information immediately. The default initial status for this record is ‘pending’. It takes about seven to 10 days for the land registry office (LRO) to certify the mortgage registration, which changes the ‘pending’ status of the mortgage record to ‘certified’. In general, around 1% of mortgage registrations will be rejected.